Meet the zerintavoqa Team

The financial experts behind Australia's most practical zero-based budgeting approach. We're not just advisors—we're real people who've walked the same financial journey you're on right now.

Our Real-World Approach

Here's what makes us different: we actually use zero-based budgeting in our own lives. Every month. Every dollar. Every decision.

Sarah learned this system after her divorce left her managing finances alone for the first time. Marcus discovered it during his startup years when every dollar counted. Evelyn perfected it while raising three kids on a teacher's salary.

We teach what we live because abstract financial advice doesn't pay rent or put food on the table. Our methods work in Melbourne apartments and Sydney suburbs, for tradies and teachers, students and retirees.

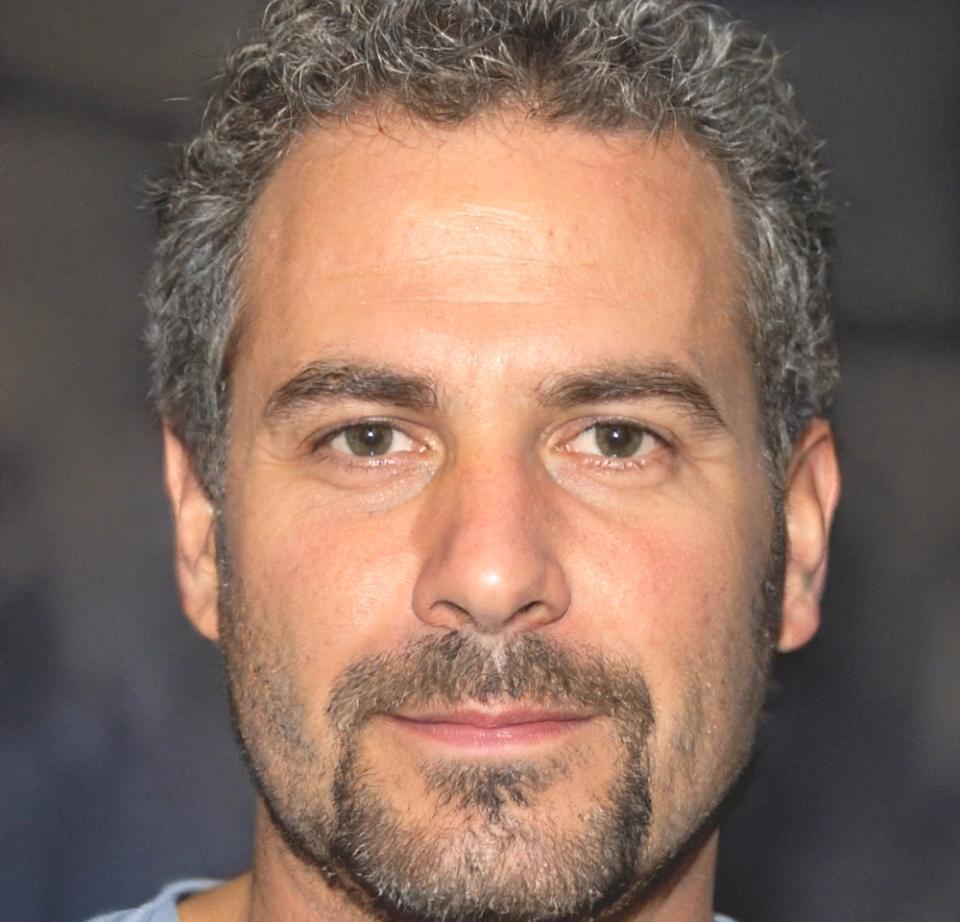

Sarah Kellerman

Lead Financial Coach

Former corporate accountant who discovered zero-based budgeting during her own financial reset. Sarah specializes in helping people transition from traditional budgeting methods to this more intentional approach. She's particularly good at working with people who've tried budgeting before and felt like failures.

Marcus Thornfield

Small Business Specialist

Started three businesses before age 35 and learned budgeting the hard way—by nearly losing everything twice. Marcus helps small business owners separate personal and business finances using zero-based principles. His background includes everything from food trucks to consulting firms.

Evelyn Pritchard

Family Finance Advisor

Twenty years of teaching primary school gave Evelyn patience and the ability to explain complex concepts simply. She developed our family budgeting workshops after successfully using zero-based budgeting to save for her children's education while supporting her elderly parents.

What We Actually Do

Forget generic financial planning. We focus on the specific challenges that keep Australians awake at night—mortgage stress, irregular income, unexpected expenses, and the constant feeling that money disappears without a trace.

Crisis Budget Recovery

When life throws curveballs—job loss, medical bills, divorce—we help you rebuild financial stability using emergency zero-based budgeting techniques that prioritize survival first, then recovery.

Irregular Income Management

Freelancers, contractors, and seasonal workers need different strategies. We teach you how to budget when your income changes month to month, including building buffer zones and priority systems.

Debt Elimination Planning

Zero-based budgeting reveals exactly where your money goes, making it easier to find funds for debt repayment. We help you create aggressive but sustainable debt elimination plans.

Goal-Based Saving

Whether it's a house deposit, emergency fund, or family holiday, we show you how to assign every dollar a specific job—including the dollars earmarked for your dreams.

How We Actually Help

Most financial advice feels theoretical. Ours doesn't, because we start with your actual bank statements and real expenses, not textbook examples.

We meet you where you are—whether that's drowning in receipts, avoiding money conversations, or feeling overwhelmed by conflicting advice from family and friends.

Our workshops happen in community centers across NSW, not fancy boardrooms. We use whiteboards and calculators, not complicated software. And we always end with concrete next steps you can implement immediately.